United States President Donald Trump imposed an additional 25 percent tariff on India for its imports of Russian oil, claiming the trade was helping fuel Russia’s war in Ukraine. This move places India in the highest tier of nations subject to U.S. tariffs so far.

While New Delhi and Moscow have long been strategic partners dating back to the Cold War, with Russia supplying a significant portion of India’s defense arsenal, Trump’s criticism has focused largely on India’s surge in oil imports from Russia.

India was, he noted on his Truth Social platform on July 30, “Russia’s largest buyer of ENERGY, along with China, at a time when everyone wants Russia to STOP THE KILLING IN UKRAINE – ALL THINGS NOT GOOD!”

On August 19, U.S. Treasury Secretary Scott Bessent told CNBC that “some of the richest families in India” were the primary beneficiaries of these imports.

Reliance Industries at the Center

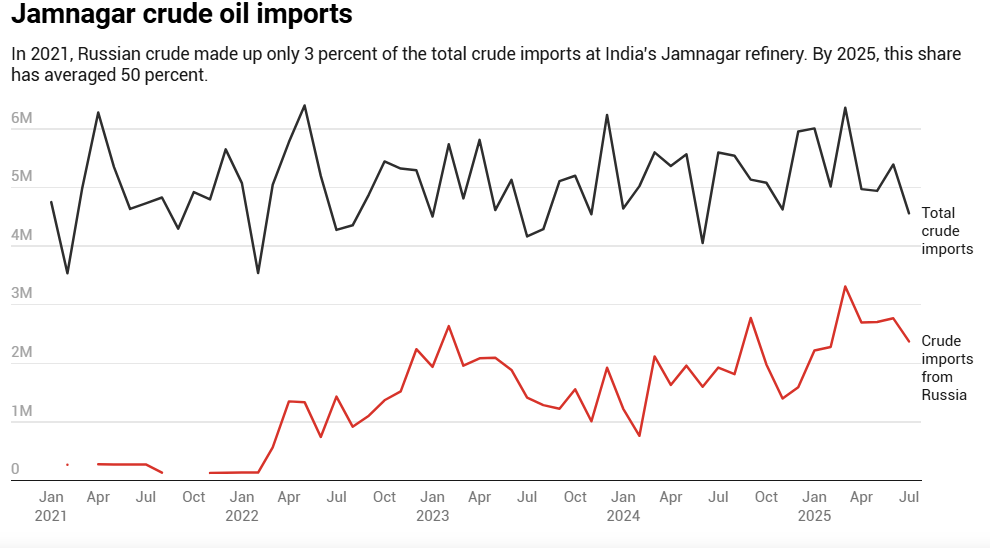

The biggest importer of Russian seaborne crude in India has been Reliance Industries (RIL), led by Asia’s wealthiest individual, Mukesh Ambani. Russian crude accounted for just 3 percent of RIL’s Jamnagar refinery imports in 2021. By 2025, this figure had surged to an average of 50 percent, according to the Finland-based Centre for Research on Energy and Clean Air (CREA).

From January to July 2025, the Jamnagar refinery imported 18.3 million tonnes of Russian crude, a 64 percent year-on-year increase, valued at $8.7 billion. RIL’s imports in the first seven months of 2025 were just 12 percent lower than its total Russian crude imports in 2024.

Vaibhav Raghunandan, an EU-Russia analyst at CREA, explained to Al Jazeera that the price cap on Russian oil products, which began on February 5, 2023, was intended to limit Russia’s revenues while maintaining global supply.

“The initial purpose of the price cap was to curtail Russian revenues, while also ensuring security of supply globally,” said Raghunandan. “A lowered price cap is technically supposed to make this oil more attractive for countries like India and China, but restrict Russian revenues.”

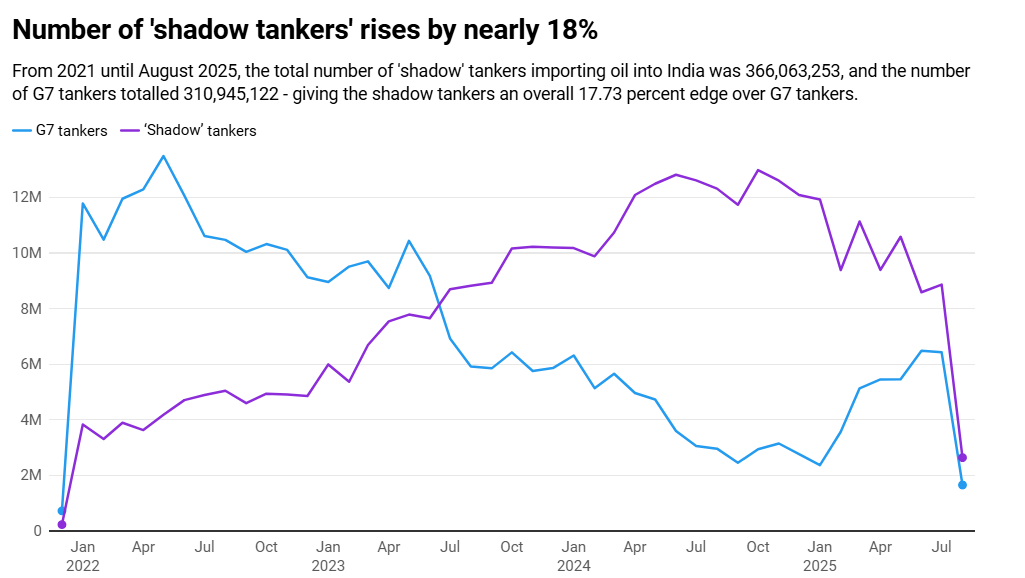

However, stagnation of the price cap at $60 for over three years and weak enforcement have lessened its effect. Instead, a shadow fleet of Russian-operated vessels has allowed buyers to pay above the price cap. As recently as January 2025, 83 percent of Russian crude was transported via these vessels; by June, that had dropped to 59 percent.

CREA tracked RIL’s Russian crude imports and found that the Jamnagar refinery exported $85.9 billion of refined products globally from February 2023 to mid-2025. Approximately 42 percent ($36 billion) of these exports went to countries sanctioning Russia, with one-third ($19.7 billion) going to the EU and $6.3 billion to the U.S., of which $2.3 billion were processed from Russian crude.

The U.S. is the fourth-largest importer in value terms from Jamnagar since the price caps were implemented, topped by the UAE, Australia, and Singapore. In volume terms, the U.S. is the largest, importing 8.4 million tonnes of oil products through July 2025.

Other Major Players

After RIL, Nayara Energy, majority-owned by Russian firms including state-owned Rosneft, is another major importer. Its Vadinar refinery, India’s second-largest private refinery, sourced an average of 66 percent of its crude imports from Russia in 2025. In actual volumes, Nayara’s Russian imports amount to roughly a third of RIL’s Jamnagar imports.

U.S. Tariffs and Indian Strategy

Analysts caution against oversimplifying the U.S. tariff as targeting a single company. Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security, said:

“It seems to me that even if most of the profits went to Reliance, the Indian government has found it convenient to continue this trade with Russia, both because the cheaper oil imports helped with India’s current account deficit and also helped send a message of non-alignment.”

India has historically demonstrated strategic independence from major powers, refusing to align formally with either the U.S. or the Soviet Union during the Cold War.

Ajay Srivastava, founder of the Delhi-based Global Trade Research Initiative, told Al Jazeera that Trump’s tariffs were “a total sham.”

“The whole thing of putting tariffs is a sham when they haven’t called out the biggest importer of Russian oil that is China,” he said. “If tomorrow Trump and [Russian President Vladimir] Putin come to an agreement [over Ukraine], U.S. will find another pretext to put tariffs on India.”

The Road Ahead

Analysts predict some changes on the horizon. The EU plans to ban imports of refined petroleum processed from Russian crude, a move CREA’s Raghunandan called a “significant policy change” that, if strongly enforced, will have major impact.

More than half of RIL’s jet fuel exports currently go to the EU, and losing this market would affect revenues for certain products, potentially prompting a strategic rethink. However, RIL also signed a 10-year contract with Rosneft in December, the effects of which remain uncertain.